Although Canada is famous for its excellent health and education system, not everyone is aware of the key role taxes play in the making of its reputation. In a place where most benefits offered by the state are publicly funded, it’s essential that everyone contributes to the system to keep it running.

In Canada, an income on taxes must be paid on any taxable income a Canadian resident makes at any time in the year. This refers to the taxpayer’s income resulting from the deductions allowed by the Income Tax Act.

If you are planning to start work in Canada, this article will help you understand what to declare, when to do it, how much you can expect to pay, and how to file your tax report.

WHO NEEDS TO PAY?

If you live in Canada permanently, you’ll need to file and pay for your taxes. You’ll fall into this category if:

- You are a Canadian resident. This means you are someone who has a home, a spouse, or social ties to Canada, and you have established significant residential ties.

- You’re a factual resident. For example, if you’re working temporarily outside Canada or you spend part of the year in the U.S.

- You’re a newcomer or someone who has left their home country and moved to Canada with the intention of settling down. You’ll be considered a newcomer for income tax purposes for your first year only.

- You’re an indigenous person who needs to claim benefits (unless they’re exempt under section 87 of the Indian Act).

NOTE: if you are the legal representative of the estate of a person who died last tax year, you will have to file a tax return for that person too. Check what you need to do on the official government website.

You’ll only be considered a non-resident if you live outside the country for more than 183 days per calendar year. However, you’ll still have to file your taxes if you have received income from Canada. If you are unsure, you can check if your circumstances require you to pay taxes on the official government webpage.

WHEN SHOULD I FILE MY TAXES?

Income tax for a fiscal year is due on the income you received from January 1 to December 31 the previous year. Canadian income tax is deducted at source by the employer from the wages paid to the employee. The employer is then responsible for remitting this tax to the Canada Revenue Agency.

However, this deduction-at-the-source system does not exempt the citizen from completing and filing their income tax return before the deadline. The deadline to file your tax return is April 30 (or June 15 if you’re self-employed) following the end of the tax year.

If the withholding taxes are higher than the amount of tax due, the taxpayer will receive a refund. Whereas if they are lower, the taxpayer must pay the difference between what they paid and the total amount of withholding tax for the tax year in point.

WHAT DO I HAVE TO DECLARE?

Some of the common revenues subject to income tax in Canada are:

- Employment income received in Canada (wages, salaries, bonuses, tips). You may also have to declare other sources of income earned outside Canada after you became a Canadian resident. This may be exempt from tax if the country you earned your money in has a tax treaty with Canada, but you still need to report it.

- Property income

- Business and investment income

What can be deducted?

The expenses that can be deducted from all taxable income are the following:

- Professional expenses (mileage expenses)

- Child support payments

- Donations (only a percent may be deductible, the administration will calculate it for you)

- Childcare expenses

- Loans interests

You can find out about deductible fees and how to fill the right line on your income tax return on the official webpage.

HOW TO FILE YOUR TAXES

The Canadian government collects taxes on behalf of most provinces and territories, except for the Province of Quebec. This means you’ll only need to file one income tax return per year. It’s important you use the income tax package that corresponds to the province or territory you reside in, as rates vary significantly.

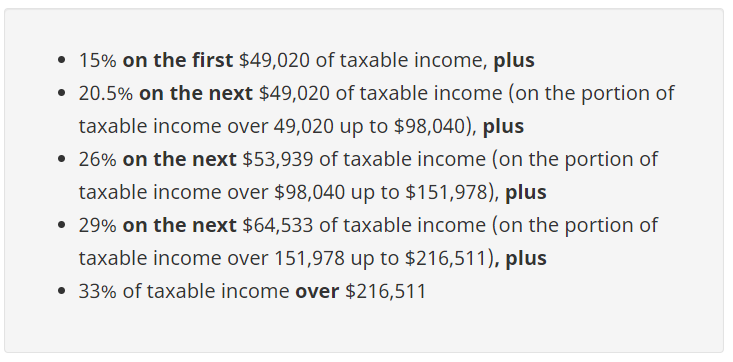

How much you can expect to pay will depend on how much you earn. This is a progressive tax system: the more income you receive, the more taxes you pay. Canadian income taxes are calculated by applying a federal tax rate to the person’s income.

In the year 2021, the average rates will be as follows:

You can pay your balance in full or by installments, but some interest or penalties may apply if you fail to pay your taxes on time. You can choose the payment method that best suits you: online, in person, or by mail.

NOTE: In addition to the rates expressed above, some provinces may impose a tax of between 4% to 20.3% on your net income. You should check the rates that apply to you on your local webpage.

Filing your taxes

You’ll be asked to submit:

- Your social insurance number and other personal data on page 1 of your return tax. The CRA needs this information to assess your tax return and calculate your goods and services tax/harmonized sales tax (GST/HST) credit, plus any benefits to which you may be entitled under the Canada child benefit.

- Date of entry to Canada (if you’re an immigrant)

- Your partner’s net world income, which is the income earned outside of Canada in the period you were a resident of Canada.

- Income T-slips (T4s, T5s, etc.) or RL-slips (RL-1, RL-2, RL-3, etc.)

- Records of any other income, such as an income statement from your self-employment

- Receipts for tax deductions (such as, medical expenses, charitable donations, childcare or caregiver expenses, monthly transit passes, etc.)

- The tax package sent to you by the Canada Revenue Agency (CRA) or the Agence du Revenu du Québec (ARQ), including your access code to file online or by telephone (If CRA or the ARQ did not send you a package for the current year, you can get a general income tax form online or from any post office for the federal return or from most caisses Desjardins branches for the Quebec return.)

You can file your taxes by using one of the following available ways:

- Online by using one of the two available systems:

- EFILE: this is a service that allows authorised service providers to send individual income tax return information to the Canadian Revenue Agency (CRA) for a fee by using authorized software to prepare the tax return. Almost 95% of Canadians are eligible to use EFILE, but you should check if any exclusions apply to you.

- NETFILE: this is a service that allows you to do your personal taxes online and send your return to CRA on your own by using NETFILE-certified software. Some software is free. However, restrictions may apply, so you’ll need to check if you’re entitled to use this.

- By post. Whether you are a resident or a non-resident, you can mail your return to your local tax centre. You must order the income tax package, as it will include the T1 return paper you’ll need to submit to the tax centre. Find out which tax centre address you should send your return to.

- By using a community volunteer tax clinic. If you have a modest income, a volunteer can help you file your taxes for free.

- By authorizing a representative to file your taxes for you. This could be an accountant, bookkeeper, lawyer, or a friend, among others.

NOTE: When you file your taxes online, it usually takes CRA 2 weeks to process it. If you choose to file your tax by mail, processing times may take longer. You can check the status of your tax return on the government’s portal My Account.

WHAT HAPPENS AFTER I APPLY?

A notice of assessment (NOA) will be sent to you by the Canada Revenue Agency. This is an evaluation of your tax return that includes the date your tax return was checked, and the details about how much you may owe. You’ll also find out whether you should get a refund or credit. The NOA is an important document, so keep it safe with your tax records.

You can also request a proof of income statement. This is a document that serves as a generic version of your tax assessment. It summarizes your income and deductions for a specific tax year and serves as proof of income to be presented before banks or government offices, among others.

NOW YOU KNOW

Income taxes are essential to keep a number of social services healthy and running; Canadia unemployment insurance benefits, pension programs, and health insurance are considered one of the best in the world, but can only continue to be so if we all contribute. Don’t forget to check the deadline each year and file your taxes so we can all keep enjoying this country’s amazing benefits and services.