Are you dreaming about retirement? After many years of hard work, there’s nothing better than the promise of a well-deserved rest to enjoy free time and the things we like in life.

But before you get to do that, you’ll need to decide at what age you would like to retire to make sure you have enough money to support yourself for the entire length of your retirement. You should consider the lifestyle you want to lead, financial obligations, expenses, hobbies, and any travel plans you may have.

Fortunately, Canada offers a variety of public pension plans to which you could qualify. The most common ones are:

- The Canada Pension Plan (CPP)

- The Guaranteed Income Supplement (GIS)

- The Old Age Security (OAS)

- The Survivor’s Pension

Let us tell you more about each of them, the requirements, the payments, and how to apply for these benefits.

THE CANADA PENSION PLAN (CCP)

It is a taxable monthly payment that provides partial income replacement upon retirement for life. To be eligible, you must:

- Be at least 60 years old

- Have made at least one valid CPP contribution (either as a result of employment in Canada or of credits received by a deceased spouse or common-law partner at the end of the relationship)

It’s important to know that payments are not automatic: you must apply in advance to receive them. So, you must plan and submit your application before the date you want to start receiving your pension.

How can I apply?

At the moment, you can choose to apply either:

- Online. You must use My Service Canada Account (MSCA) to submit your application. You’ll be able to see an estimate of what you’ll receive. You will get a decision in the mail between 7 and 14 days after you applied.

- Using a paper application. You must download the application form and submit it to your nearest Service Canada Office. You can find out the right address here.

Note: if you live outside Canada, have an authorized third party managing your CPP account, are receiving another CPP pension (disability, survivor’s, or children’s benefit), or have been denied a CPP benefit in the past, you must apply using a paper form.

How much will I receive?

The amount of your monthly benefit is based on your average earnings throughout your working life, your CPP contributions, and the age at which you decide to retire. The earlier you retire, the less money you will receive through your pension. Most people decide to retire at 65, but you can do it as early as age 60 or as late as age 70.

The average monthly amount in June 2021 is $619.68. However, different circumstances may affect the amount you will receive, such as periods of disability, unemployment, or the time off you took from work to raise your children. You can use the official Canadian Retirement Income Calculator to get an estimate of how much your pension will be.

Note: there’s no legal reason why you couldn’t continue working while you receive a CPP pension. In fact, this could help bump up your pension. To learn more about this, click here.

When will I get paid?

Once you start your CPP retirement pension, your monthly payments will be directly deposited into your bank account every month. There is an increase in January of each year if the cost of living goes up. This is determined by the Consumer Price Index. Your monthly payment won’t decrease if the cost of living goes down.

THE GUARANTEED INCOME SUPPLEMENT (GIS)

The GIS is a monthly payment for people receiving Old Age Security (OAS) pension who have a low income. Unlike the CCP, the Guaranteed Income Supplement is not taxable.

To be eligible, you must:

- Be 65 years of age or older

- Live in Canada

- Receive Old Age Security (OAS) pension

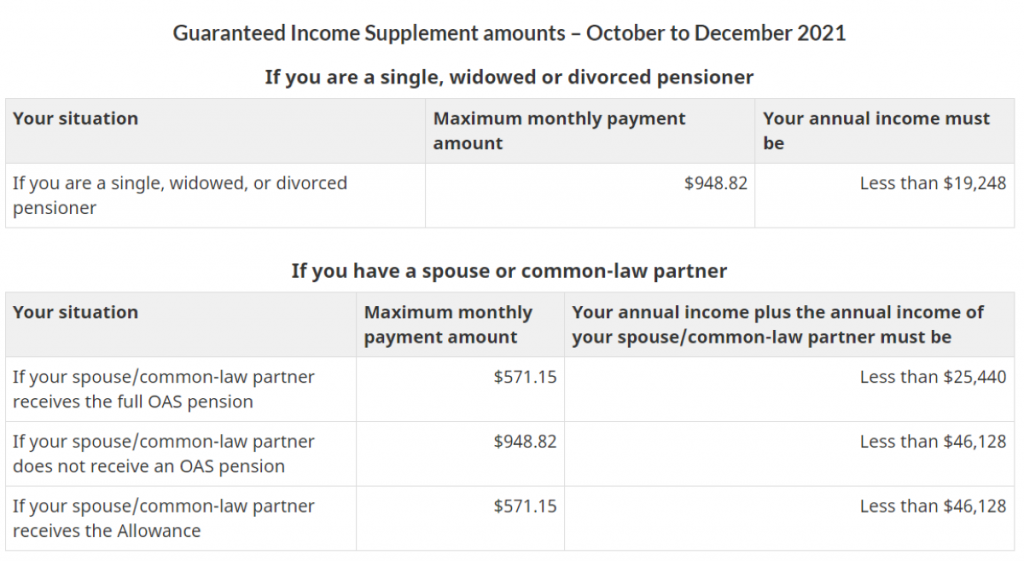

- Be single, widowed, or divorced and have an income under $19,248

- Be married and have a combined income of less than:

- $25,440 if your partner receives the full OAS pension

- $46,128 if your partner does not receive an OAS pension

- $46,128 if your partner receives the Allowance

How can I apply?

If the government has enough information about your situation, they may enroll you automatically. In that case, you can expect to get a letter when you turn 64 stating when you will start receiving payments. Otherwise, you will have to apply for it.

In that case, you can choose to apply:

- Online. You must use My Service Canada Account (MSCA)

- Using a paper application. You must download, complete, and mail form (ISP-3550) with certified copies of the required documents to your nearest Service Canada Office.

Make sure you have the required information ready, such as your Social Insurance Number (SIN), before you apply.

How much will I receive?

How much you can expect to receive will depend on your marital status. For the last part of 2021, the updated figures are:

When will I get paid?

You will start receiving payments the month after you turn 65, either by cheque or by direct deposit to your banking account in Canada. If you would like to receive the money by direct deposit, you need to sign up for it.

To avoid interruptions in your payments, it’s essential that you file your tax return on time each year.

THE OLD AGE SECURITY PENSION (OAS)

The OAS pension is one of the three main pillars of Canada’s retirement income system with the CPP and the Individual Retirement Saving. It is a taxable monthly payment available to seniors who are aged 65 and older and who meet the eligibility requirements. Unlike the CPP, OAS benefits are not tied to your employment history. You may be eligible to receive the OAS pension even if you have never worked or are still employed.

To be eligible, you must:

- Be at least 65 years of age

- Have an annual income that doesn’t exceed $19,248 (if you have worked)

- Be a Canadian citizen or legal resident who has lived in Canada for at least 10 years after you turned 18

- If you live outside Canada, you must have been a Canadian citizen or legal resident before you left Canada. You also need to have resided in Canada for at least 20 years after you turned 18.

Note: There are a few other options where you may be eligible for the OAS; for example, if you have lived in a country with which Canada has established a social security agreement.

How can I apply?

In most cases, Service Canada will inform you if you have been automatically enrolled to access this benefit. However, if they don’t have enough information about your situation, you may be asked to apply to receive it.

In that case, you can choose to apply:

- Online. You must be at least 64 and a month old, be living in Canada, and have never applied or received OAS pension. You’ll need to have a My Service Canada Account (MSCA) to apply. You can create an account here if you don’t have one.

- Using a paper application. You will have to download, complete, and mail your application form (ISP-3550) with certified copies of the required documents indicated on the form to your nearest Service Canada office.

How much will I receive?

You can receive up to $635.26 per month (October to December 2021 maximum monthly payment). The exact amount you will receive depends on where you lived after you turned 18 and how long you lived in Canada.

Old Age Security payment rates are reviewed in January, April, July, and October to ensure they reflect the cost of living increases.

When will I get paid?

You will start receiving this benefit the month after you turn 65. If you want to increase the amount you get each year, you may choose to delay your first payment for up to 5 years. But do not delay your first payment if you are over the age of 70 or you may risk losing the benefit.

THE SURVIVOR’S PENSION

The Canada Survivor’s Pension is paid to the spouse or common-law partner of a deceased contributor. To prove that you were in a common-law partnership you need to fill out a form (ISP3104CPP).

Note: if you are divorced from a deceased contributor and the person has not remarried, you may be eligible to receive this benefit. For more information, click here.

How can I apply?

You have to apply as soon as possible after the contributor dies. If you delay your application, you may lose the chance to obtain these benefits, as payments can be retroactive for up to 12 months only.

You can choose to do so:

- Online with My Service Canada Account (MSCA). You’ll be asked to mail certified true copies of the required documentation or drop them in person at a Service Canada Office.

- Using a paper application. You will have to download, complete, and mail your application form (ISP1300) with certified copies of the required documents indicated on the form to your nearest Service Canada office.

How much will I receive?

The amount you will receive as a surviving spouse or common-law partner depends on the following:

- Whether you are under or over 65

- How much the deceased contributor has paid into the CPP and how long the contributory period was

The rate portion of the contributor’s retirement pension you can receive ranges from 60% (if you are 65 or older) to 37.5% (if you are under 65).

When will I get paid?

It takes approximately 6 to 12 weeks from the date that Service Canada acknowledges receipt of your completed application before payments can begin. The survivor’s pension begins to be paid the month following the contributor’s death.

Please note: you cannot receive a full Survivor’s Pension while also receiving a full Retirement Pension or disability benefits. The combined benefit is not necessarily the sum of the two benefits.